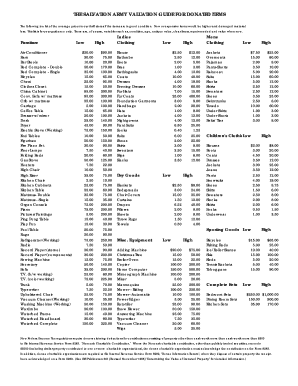

Salvation Army Donation Valuation Guide 2016

Valuation Guide: Determining the Value of Your Donation Value Guide for Salvation Army Donations These page will assist you in determining the tax-deductible value of any items you are donating to The Salvation Army. Your qualifying tax deductible donations are resold through our through the country and serve to fund our. The Donation Process When making your donation, you will be required to fill out a form indicating what you are donating and the estimated value of your donation.

Salvation Army Donation Valuation Guide 2016

Please choose a value within this range that is in keeping with your item’s relative age and quality. A receipt for your items may be obtained in one of three ways:. If you drop off a donation at a local Salvation Army Family Thrift Store or Corps (worship and community center), the clerk or receptionist will be happy to provide you with a receipt.

If your items are dropped off at an unattended Salvation Army drop-box, an itemized list is required to receive a receipt. Your local Salvation Army Corps or Family Thrift Store can have a receipt made out for you once you bring this list to them. Please itemize your donations with the value next to them to claim them for your taxes.

Your tax consultant will be the best resource for advice on how to itemize and submit this information. If you have your donations picked up, the truck driver will provide you with a receipt. Value Tables Tax Considerations New Federal Income tax regulations require donors claiming deductions for charitable contributions consisting of property other than cash worth more than $500 to file Internal Revenue Service Form 8283, Non cash Charitable Contributions. For detail information from the IRS on determine the value of donated property, download the following IRS publication. About The Salvation Army, an evangelical part of the universal Christian church established in 1865, has been supporting those in need in His name without discrimination for 130 years in the United States. Nearly 30 million Americans receive assistance from The Salvation Army each year through the broadest array of social services that range from providing food for the hungry, relief for disaster victims, assistance for the disabled, outreach to the elderly and ill, clothing and shelter to the homeless and opportunities for underprivileged children.

We would advise that all items are returned in a traceable manner.  All cancellations of an order must be made in writing (via email or by letter) with cancellation date no later than 7 days after the date of delivery of your item We do not accept cancellation of orders 7 days after date of delivery of goods. Returns are your (The Buyer) responsibility and any costs incurred for returning are to be paid by you and are not reimbursable.

All cancellations of an order must be made in writing (via email or by letter) with cancellation date no later than 7 days after the date of delivery of your item We do not accept cancellation of orders 7 days after date of delivery of goods. Returns are your (The Buyer) responsibility and any costs incurred for returning are to be paid by you and are not reimbursable.

82 cents of every dollar spent is used to support those services in 5,000 communities nationwide.

Salvation Army Donation Valuation

JGI/Jamie Grill/Getty Images Giving away your stuff that no longer brings you joy may instead bring happiness to others who could use them. An added bonus: You get a tax deduction for your charitable donations if you itemize deductions. However, it’s your job to keep track of the items you give to charity so you can report their value to the Internal Revenue Service. Donated clothing and other household goods must be “in good used condition or better.” If you claim a deduction of $500 or more for a used item that’s not in good condition, the IRS says you’d better get an appraisal. Several computer software programs are available to help you figure the tax value of your donated stuff. The list of some common items, below, gives you an idea of what your donated clothing and household goods are worth, as suggested in the.